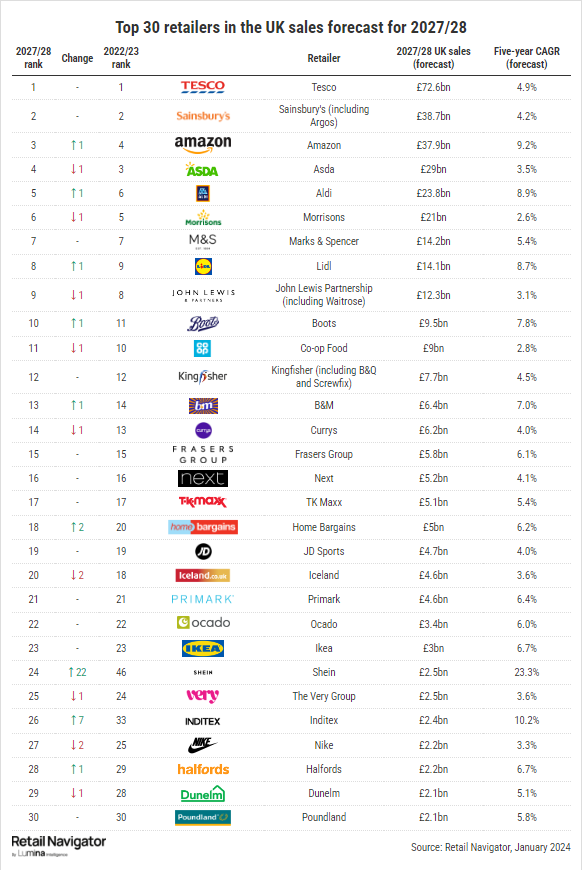

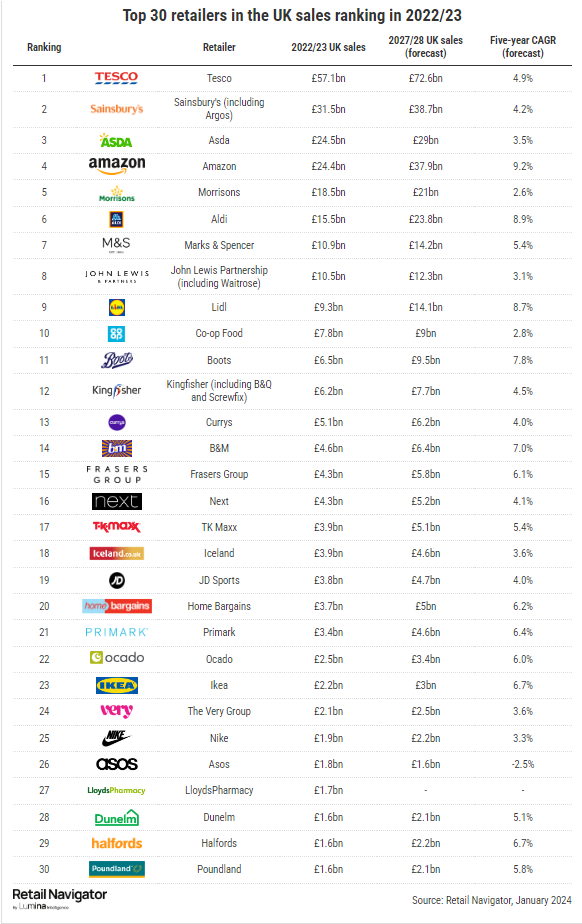

Ranking: The top 30 biggest retailers in the UK and where they’ll be in three years

2024.02.23

Asos gets the boot, the discounters hit peak growth, Shein soars and more in our annual ranking of the 30 biggest UK retailers and where they’ll be in three years.

Our annual ranking of the 30 biggest UK retailers and five-year forecast from FY2022 is never short of thrills and spills.

This year, in partnership with our sister brand Retail Navigator by Lumina Intelligence, we reveal that Asos will get pushed out, the discount grocers will hit their peak and fast-fashion juggernaut Shein will skyrocket up the chart.

For all the chatter we hear about eco-conscious consumers turning their backs on fast fashion, the reality is that Brits are not much closer to walking the walk.

This year, new entry Shein is forecast to absolutely storm the ranking, rising an incredible 22 places from 46 to 24 by the year 2027.

Perhaps the retailer that encapsulates fast fashion in its truest form, Shein has a forecast compound annual growth rate (CAGR) of 23.3%, more than double any other retailer on the list, and the next few years will see it firmly cement itself as one of the 30 biggest retailers in the UK.

Incredible growth

Shein’s meteoric rise in the UK is no accident. According to Retail Week data and insights director Lisa Byfield-Green, the retailer has been working to make a home for itself here in the last year.

Shein is showing a “strong commitment to the UK market”

“Shein is working to legitimise its position across Europe and particularly in the UK and that’s something that is working in its favour,” she says.

“The company opened offices here in November and acquired Missguided in October so that will be taken into account in the five-year forecast.

“It’s too early to say what Shein’s plans are with Missguided as there hasn’t been much time to do a lot yet, but it really shows a strong commitment to the UK market.

“Another positive is Shein’s widening of its appeal through social media. It is really keen to get a foothold and a reputation in the UK, and recent activity demonstrates it is actually starting to now think about it as a key market.”

But Shein’s rise hasn’t been without its casualties. Eagle-eyed readers will notice that the forecast no longer features home-grown fashion retailer Asos, which is set to tumble out of the top 30 by 2027.

Asos tumbles out

Asos was the only retailer in the current top 30 with a negative CAGR, forecast to drop by 2.5% to £1.6bn over the next five years.

The retailer’s total sales declined by 10.1% to £3.5bn in the year to September 3, 2023, UK sales fell by 11.8% and losses at pre-tax and operating levels widened too, with a reported pre-tax loss of £296.7m.

“Asos has seen a very challenging environment,” says Byfield-Green.

“Customer loyalty to Asos is not that strong”

“It says the economic headwinds that we’re seeing particularly affected younger shoppers, and some of the evidence does point to that, but that’s not the whole story.

“Customer loyalty to Asos is not that strong and other retailers are undercutting it on price. If customers don’t have a lot to spend, why go to Asos rather than Shein?”

To break out of the cycle, Asos chief executive José Antonio Ramos Calamonte has laid out plans to revitalise the business by sharpening its operating model, tightening its stock management and getting clothes to market even faster.

The retailer wants to implement a shift “back to fashion” for the 2024 financial year and promises to build the strength of its own brand and the range of partner brands it stocks.

But it’s not just the rise of Shein that Asos needs to worry about.

Inditex storms ahead

Another competitor success story that may have played a part in Asos’ struggles is Inditex.

The Spanish group has climbed seven places to enter the ranking at 26, overtaking Nike and Dunelm.

The Zara owner is set to clock up impressive growth over the next few years, with a CAGR of 10.2% taking it to £2.4bn.

Much of this growth is accredited to investments in its store estate, says Lumina Intelligence senior retail analyst Beth Bloomfield.

Zara owner Inditex climbs seven places up the ranking

“Inditex continues to build momentum in the UK through expanding its number of Zara stores – with new openings in Bath and Glasgow at the end of 2023 – as well as pushing its other banners,” she says.

“Its sportswear brand Oysho opened its first UK store last year, a new challenger to other more established women’s sportswear labels.

“A relentless focus on seamless experience sees its Zara stores supported by a compelling ecommerce offer; app users can get orders delivered to store in as little as two hours as well as skip changing room queues.

“It’s also been harnessing the latest technology and aims to remove hard security tags in its stores by the end of 2024, giving its customers an even faster checkout experience.

“That paired with its localised supply chains, where garments can move from design to shopfloor in as little as four weeks, will see Inditex continue to gain ground in the UK retail market.”

Strategy first

In grocery, the table movements might not be quite as dramatic, but they are no less significant.

Tesco and Sainsbury’s maintain their positions at first and second, although Amazon looks to be hot on the heels of the silver-medal position with a CAGR of 9.2% and an £800m gap between it and Sainsbury’s.

Both top grocers are expected to bring in healthy growth, sitting around the 4-5% mark, which our analysts say is likely to be because of their current strong strategies.

“Both Sainsbury’s and Tesco have spent a lot of time understanding customers and honing their growth strategies,” says Byfield-Green.

“Areas they have invested in include value, range, loyalty and putting the customer at the heart of what they do. Investment in retail media will play out for them, too, over the next five years.”

Asda has been pushed down a position by Amazon, but that has more to do with the ecommerce giant’s success than the grocer’s performance.

Asda’s healthy growth rate is assisted by its convenience and forecourt strategy

Asda’s healthy 3.5% growth rate is assisted by its convenience and forecourt expansion strategy, which has seen it get on track to convert all 470 convenience sites acquired from the Co-op and EG Group to Asda Express stores by the end of next month.

Although Asda co-owner Mohsin Issa told the press a couple of years ago that he had his sights set on becoming the UK’s second-biggest grocer, Asda’s forecast is not likely to cause concern for Sainsbury’s (with a CAGR of 4.2%) quite yet.

“We’ve seen Clubcard Prices and Nectar Prices driving growth for the big grocers, but Asda has only just rolled out discounter price matching. OK, they’re matching Aldi and Lidl, which is innovative, but we’re yet to see how that’s going to play out over time, which means it is not yet reflected in the forecast.

“It could be amazing, but it also feels like Asda’s leadership isn’t as strong as the other grocers right now.”

Morrisons’ CAGR is the lowest of the grocers at 2.6%, but it remains to be seen if the bold approach by new chief executive Rami Baitiéh will turn its fortunes around.

Discounters top out

The forecast also suggests we may have hit peak growth for discounters Aldi and Lidl. Although they have some of the strongest CAGRs in the table, according to Byfield-Green the next five years are unlikely to deliver quite as exuberant growth for them as we have seen so far.

“The discounters have peaked,” she says. “They had such a strong year last year and we’re not expecting to see such incredibly high levels of growth from them over the next five years.

“But what they have gained is a lot of new customers and they have cemented their places as an integral part of the UK grocery landscape.

“Now their rate of store openings has slowed and their store-opening ambitions appear to have lessened because actually they are nearing a good number of stores for the UK now.”

It’s likely that the lifestyle changes shoppers have picked up during the cost-of-living crisis will stick when it comes to value variety retailers, too.

B&M’s expansion plans, like its Wilko store purchases, and other in-store investments will see it grow by 7% to £6.4bn, solidifying its position as the leading value variety retailer.

Competitor Home Bargains is climbing up the ranking for 2027, too, moving up two places to 18, with turnover expected to reach £5bn.

“Value will remain a strong part of the retail landscape. People’s habits have changed and it’s been long enough now that we’re not going to switch straight back easily, even once we begin feeling more flush,” says Byfield-Green.

“That’s why the value retailers are in such a strong position. Some of them are still expanding, but even the ones that aren’t have just gained a load of shoppers.

“But in the next few years, as inflation eases, we’re going to have much higher expectations as customers. As long as they continue to do a good job of brand innovation, operational efficiency and focusing on the in-store experience, they’ll remain in a good position.”

Visitor Registration

Visitor Registration Booth Application

Booth Application